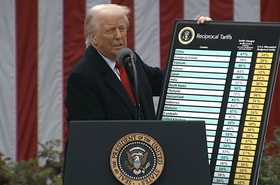

At the start of this month, President Donald Trump revealed his much-awaited "liberation day" tariffs.

Global financial markets have gone into a spin, and as DCD's own Matthew Gooding detailed in a feature shortly after, the data center industry will likely be deeply impacted.

The tariffs applied vary country to country - with a baseline of 10 percent placed on all imported goods coming into the US - and much higher being applied to those countries described by Trump as “the worst offenders," up to 99 percent in the case of the French archipelago Saint Pierre and Miquelon.

However, most pertinent to the cloud computing industry are the tariffs that will hit countries that provide essential computing hardware, and materials necessary to data center construction.

Semiconductors - while currently exempt from country tariffs - are expected to see tariffs starting at 25 percent and then keep rising over the course of this year.

In response to tariffs, we have already seen Micron inform US customers that it will be imposing a surcharge on memory modules and SSDs (solid-state drives) starting April 9. CEO Sanjay Mehrota said of the move: "Where tariffs do have an impact, we intend to pass those costs along to our customers.”

Micron's manufacturing sites span East Asia, including Taiwan, Japan, Malaysia, and Singapore, which are facing tariffs of 32 percent, 24 percent, 24 percent, and 10 percent, respectively.

The company also has a manufacturing base in China, a country that saw a 34 percent tariff placed on it over the weekend but has since been threatened with an additional 50 percent tariff by Trump after the country announced it would be imposing reciprocal tariffs on the US. (At time of publication, US tariffs on China sit at 104 percent, with China having placed retaliatory tariffs on US goods of 84 percent.)

While cloud service providers (CSPs) will certainly be hit by the inevitable rising costs, it is hard to really think of the hyperscalers as the "victims" in this story. Microsoft, Amazon, and Alphabet all lie in the top five companies by market cap, and none have taken particularly drastic hits to their stock value since the news of the tariffs was announced.

But should costs increase for CSPs, many of which endorsed Trump during his election campaign, it seems inevitable that they too will pass on costs to their customers.

This time last year, while looking into the impact of data egress fees on customers, Kevin Cochrane, CMO at Vultr, explained to DCD that Vultr, while charging significantly less than hyperscalers, was still "wildly profitable," adding: "That's how badly they are overcharging."

While egress fees themselves are not relevant to the tariffs conversation - and have been at least partially removed themselves by the hyperscalers - what it does demonstrate is that with market power comes a comfortability in charging extra. With tariffs providing an ideal excuse, why wouldn't the CSPs that dominate the market take the opportunity to increase prices?

The uncertainty of this was also noted by Mathieu Colas, founder of StarZData, a company that enriches organizations' B2B data with external sources and a customer of OVHcloud.

StarZData initially used Amazon Web Services (AWS) but upon finding prices to be quickly rising, migrated to a combination of OVHcloud and Google Cloud Platform (GCP), though it has since begun moving away from GCP.

Speaking to DCD, Colas noted that with OVHcloud, he fears the impact of tariffs far less.

"As a founder, I have less fear about the potential increase of OVHcloud than I would have if I were still on AWS, because the starting point isn't the same. A [hypothetical] 10 percent increase on my current bill is less of a problem than a 10 percent increase on AWS would be."

That 10 percent increase remains guesswork for the time being.

Uptime Institute's senior research director of cloud, Owen Rogers, told DCD that from his perspective, hyperscaler clouds are "caught between a rock and a hard place."

He argued that cloud resources have "generally gotten cheaper" over the past decade due to efficiency improvements and economy of scale which as been passed to customers.

"The high tariffs on servers and other IT equipment imported from China and Taiwan are highly likely to increase CSPs costs. If CSPs pass on cost increases, customers may feel trapped (because of lock-in) and disillusioned with cloud and their provider (because they've committed to building on a cloud provider assuming costs would be constant or even decline over time). On the other hand, if CSPs don't increase prices with rising costs, their margins will decline. It's a no-win situation," Rogers explained.

DCD has reached out to Google, Amazon, and Microsoft to find out if they are expected to have to increase their prices in line with the tariffs being imposed.

In addition to the impact of US-imposed tariffs, the European Union is reportedly discussing the potential of imposing retaliatory tariffs on both tech goods and services against the US, which would further hit the likes of Google, Amazon, and Microsoft. While no decision has officially been made, the uncertainty is palpable.

The solution in many cases may be for enterprises to turn to smaller cloud providers for their services. With scale not as much of a draw, many smaller companies use more affordable pricing models as a key factor of their appeal, one that will only grow stronger if prices rise.

The full impact of tariffs on CSPs' pricing strategy remains to be seen, but regardless, it will be the customers that take the real hit. I wouldn't be surprised if many board rooms are re-evaluating their IT strategy in the coming months.