And just like that, another Mobile World Congress (MWC) is done for the year.

A huge amount of steps, meetings, and tapas later, and I’m thankful to be back home so that I can get my head around the last few days.

This year’s event felt a little bit different from previous shows in that there were no real big headline announcements so instead, I've collated a few of the most notable talking points from MWC 2025.

AI was everywhere

Unsurprisingly, AI dominated most of the discussion at MWC. I don’t think I saw a stand that didn’t mention AI in some shape or form, it was absolutely everywhere.

That translated to pretty much every meeting I had as well, with vendors and operators clearly beaming about the prospects of AI.

It does feel like progress is being made with the technology, especially within networks as companies push to drive operational efficiencies and sustainability goals.

That said, it can't help but feel like one giant wave of hype, similar to what 5G was in the previous few years, and it’s fair to say that 5G hasn’t materialized as expected for mobile operators.

But perhaps AI will be different, given the implementation of the technology for companies across sectors. It’s just a matter of what those AI use cases will look like, which remains up for discussion, and how soon we will see them in everyday life.

Not just a telco show anymore

During my previous couple of visits, I’ve felt as though MWC has pivoted away from what was traditionally a mobile conference.

And this year, it felt more than ever that it’s not just a telecoms show anymore, but something way beyond that.

The stands on show at MWC this year featured robotics and the automotive industry and showcased technology solutions that serve a range of other industries, such as manufacturing, defense, and more.

Furthermore though, it shows how interconnected telecoms is with so many other industries and how vital these next-generation networks are for supporting these exciting use cases, such as robotics and autonomous vehicles.

We’re still some way off seeing them in everyday life, but in some parts of the world, the likes of driverless cars are already being used.

A lot more data center talk

For me, one of the most striking trends of this MWC was how much data center talk there was.

As someone who has covered the telecoms industry for close to a decade, I’ve never seen as much crossover between telecoms and data centers as I have now.

There are, of course, reasons for this. Most notably, the demand for AI and advanced mobile services means that there’s a lot more data being generated, and this data has to be stored, managed, and distributed somewhere.

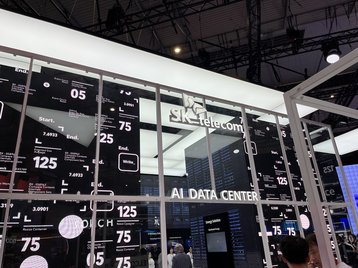

SK Telecom’s stand, for example, (pictured) centered around its data center solutions, while Nokia was keen to discuss its data center strategy, which the company has publicly spoken about over the last 12 months.

It was probably apt this week that French telco Orange appointed Nicolas Roy, CEO of its Totem towers-focused subsidiary, to lead the carrier’s data center strategy.

During a roundtable, Orange told DCD that data centers are a key growth driver for the industry, and are assets it plans to leverage.

Not so much G talk... European operators are not happy

One thing that I was a bit surprised about was that there was not as much focus on 5G as in previous years.

It could be that the industry is a bit fed up of 5G and all the promise of what it will deliver, but in reality hasn’t. However, it’s probably more just a case of being in between generations. 5G is too far along, while 6G is too far away to get too excited about just yet.

There’s still a belief that 5G will come good, though recent reports from Ookla lay bare just how much the continent has to do to close the gap with China and other markets.

According to Ookla’s 5G Standalone (5G SA) whitepaper, China has 5G SA availability in 80 percent of the country, followed by 52 percent in India and 24 percent in the US. Meanwhile, 5G SA is only available to two percent of Europe's population. That’s not just a gap, it's more of a chasm.

It translated to the mood of some of the big European telco CEOs this week too, with some calling for less bureaucracy, more consolidation (possibly cross-border), and the whole debate around fair share and who should fund the costs of network rollouts.

Deutsche Telekom CEO Tim Höttges even suggested that Europe create its own version of the Department of Government Efficiency (DOGE), that Elon Musk runs in the US.

Whether or not the latter will happen is unknown at this point, but it’s very clear that European carriers aren’t content at the moment.

What’s next?

It feels as if the telecoms industry is grappling with itself, desperately trying to monetize 5G, while keeping up with AI and looking ahead to 6G.

There was talk of 6G this year, but not a huge amount, though I’d expect that to change in the next couple of years - we’ll probably know a bit more about 6G in 2026 as 3GPP continues to update the required standards for the technology.

In all, the GSMA says more than 109,000 packed the halls at the Fira this year from 205 countries.

Next year’s show will have a new director general in Vivek Badrinath, who is due to replace Mats Granryd next month. The change of leadership will be interesting to observe, though I expect the event will continue to grow and act as a catalyst for business meetings, after-show dinners, and much more.

It will be exciting to cover this industry over the next 12 months, especially around data centers, AI, and geopolitics. Strap yourselves in, because it should be fun.