Bidders have begun circling again for data center firm Global Switch.

Citing people familiar with the matter, Reuters reports Singapore-headquartered real estate investment manager SC Capital Partners has emerged as a potential bidder for Global Switch.

The firm, backed by global real asset manager CapitaLand Investment, is said to be working with advisers to buy the London-based company.

A transaction could value Global Switch at between $4 billion and $5 billion – with SC Capital currently the only bidder for the company.

A spokesperson for Global Switch declined to comment to Reuters. SC Capital and current owner Jiangsu Shagang did not respond to Reuters' requests for comment.

Ownership of Global Switch has been an ongoing hot topic for several years. Chinese steel giant Jiangsu Shagang Group took control of the company in 2016, but has been seeking a buyer for the company since early 2021.

After years of back-and-forth with around a dozen suitors, HMC Capital acquired the Australian operations of Global Switch last year for AU$2.12 billion (US$1.41bn), taking over two facilities in Sydney. Global Switch retained around a dozen data centers across Europe and Asia, with more in development.

The UK-based company has been looking to sell a stake in its UK operations since last year to help fuel its growth plans.

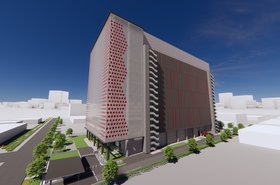

Founded in 2004, Singapore-based SC Capital is an Asia Pacific real estate investment manager with around $6bn in total investments, according to its website. Its portfolio includes industrial, retail, residential, offices, and retail properties globally. In 2022, it launched Zeus Data Centers alongside the Abu Dhabi Investment Authority, which has sites in development in South Korea and Japan.

November 2024 saw APAC asset manager CapitaLand Investment, acquire an initial 40 percent stake in SC Capital for S$280m (US$207.67m), with the option to buy the remaining 60 percent in phases over the next five years. CapitaLand owns multiple data centers across Asia and Europe.

EQT, KKR, PAG, Gaw Capital Partners, Stonepeak, Blackstone, Brookfield Asset Management, DigitalBridge Group, Digital Realty, Equinix, Australian pension fund AustralianSuper, and NextDC & Macquarie Capital have all been previously listed as potentially interested in acquiring at least part of Global Switch in recent years.