Satellite communications group Rivada Space Networks has announced a partnership with Amenum, an engineering firm with a history of contracts delivering for the US government on mission-critical projects.

Rivada is working on its 600-satellite strong LEO constellation, Outernet, which emphasizes security and is specialized for mission-critical applications.

“Security is currently a top priority. The Outernet's services are designed specifically for governments and enterprises. We work closely with resellers who already have strong connections in their markets,” a Rivada Space Networks spokesperson told DCD. “By isolating the infrastructure and creating a private network in space, Rivada is able to take a security-by-design approach and eliminate the risk of relying on third-party infrastructure deployed over vulnerable regions.”

The US Space Development Agency (SDA) aspires to produce a US military optical satellite communications network in the “Transport Layer,” a constellation of 300-500 satellites in LEO from 750km to 1200km to link up military domains to advance the DoD’s aspirations of increasingly interconnected warfare.

In early March the SDA reported another delay to the program, delaying a launch to late summer 2025 which they blamed on vendor delivery delays.

While government insiders and other spokespeople maintain the US military will always require a degree of in-house technological infrastructure, others argue that American defense procurement will become more privatized in the years ahead.

“Rivada is building a uniquely capable LEO constellation focused on zero trust networking and by establishing a highly secure global communications backbone in space,” Dave Marlowe, vice president of intelligence and cyber at Amentum said. “The Outernet not only strengthens digital infrastructure on a global scale, but it also provides an innovative platform for our US government customers to expand their capabilities to meet new challenging mission needs.”

Rivada plans to start deploying test satellites for its projected low-Earth constellation in 2026, followed by launches of operational satellites beginning in 2027.

The company enjoys the financial backing of billionaire Peter Thiel and has been lobbied for in Congress by Republican heavyweights Karl Rove and Newt Gingrich.

The optical advantage

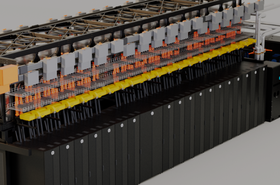

Satellite operators investing in optical inter-satellite links often tout the increased security of the technology, which sidesteps the cyber vulnerabilities of digital and RF connections. Rivada told DCD this comes down to a lower probability of successful interception.

“Laser communication operates at much higher frequencies than RF and mmWave technology, which translates into a much narrower light beam than what RF offers,” Rivada said. “Inter-satellite optical beams happen in space and the orbital mechanics of the satellites make it highly difficult to continuously intercept any such connections. To theoretically intercept an on-going laser communication the orbit of the spy satellite needs to know when, how, and in which direction the two satellites point relative to each other both in attitude and altitude. This alone makes the interception unfeasible.”

A foot in the door?

Rivada isn’t the only space company interested in folding in trusted developers with a history of selling to US government and military in a bid to establish a firmer presence, putting their products in the hands of faces familiar at the Pentagon.

“With Rivada, they can add highly secure connectivity for sensitive data to their offering and create suitable packages for their customers,” Rivada told DCD. “Whether the Pentagon will be one of those customers remains to be seen. What we do know is that we are getting a lot of positive feedback from governments and government integrators.”

Rivada has previously secured a contract with the US Navy.

Other similar deals include French multinational aerospace and defense corporation Thales purchasing California-based data and application cybersecurity group Imperva. At the time, Imperva was valued at $3.6 billion.

In the same year, Israeli satellite technology developer Gilat acquired secure communications developer Datapath, who was awarded a 10-year sustainment contract with the United States Department of Defense for $3.2 billion in July 2023.