North American investment firm Novacap has closed its first digital infrastructure fund. The firm has also named its recently announced data center joint venture with H5, HyScale Data Centers.

The private equity firm this week announced the final closing of Novacap Digital Infrastructure Fund I, the firm's first fund dedicated entirely to investing in digital infrastructure.

The company said the fund exceeded its target and raised more than $1 billion from existing and new institutional investors, family offices, and high-net-worth investors from North America, Europe, the Middle East, and Asia.

The fund will focus on equity investments in North American lower mid-market companies providing “essential connectivity and data access services backed by robust, existing physical assets,” according to the company.

“I would like to thank our long-standing investors for their support and take this opportunity to welcome new investors to our new platform,” said Pascal Tremblay, president, CEO, and managing partner, Novacap. “A commitment of this size for a new platform is a testament to our experienced and dedicated team's track record of helping entrepreneurs build leading companies while delivering sustainable long-term value to all stakeholders.”

The fund has already invested in four platform companies: INdigital, a provider of 911 services; All West Communications, a broadband network operator; Communications Tower Group, a developer and acquirer of wireless digital assets; and HyScale, a recently formed owner and operator of data center assets.

Evercore Private Funds Group served as the exclusive global placement agent, and Davies Ward Phillips & Vineberg LLP served as fund counsel.

“The substantial demand that the fund received in this highly competitive fundraising market really speaks to the caliber of their team and to their differentiated investment strategy,” said Alex Russ, senior managing director at Evercore. “We are delighted to have partnered with Novacap on their successful fundraise and congratulate the entire Novacap team on reaching this important milestone in the firm's history.”

Founded in 1981, Novacap is a Canadian private equity firm with more than C$10 billion (US$7bn) in assets under management.

Earlier this month, the company formed a data center joint venture with H5 to develop facilities across North America. This is likely the HyScale investment referenced this week.

At the time Novacap said the JV with H5 was the investment company’s fourth investment made through its digital infrastructure platform.

There is little information about Hyscale available online and it is not currently listed on Novacap’s portfolio page, but LinkedIn profiles of Novacap employees describe Hyscale Data Centers as a JV in partnership with H5 Data Centers.

HyScale’s first investments may be data centers in the US previously operated by Yahoo!.

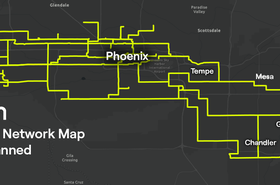

Reports surfaced this week that H5-affiliate Hyscale Data Centers Lockport LLC had acquired Yahoo!’s data centers in Lockport, New York. H5 has also seemingly taken over other Yahoo! sites in Quincy, Washington, and Omaha, Nebraska.

DCD has reached out for more information.