Australian firm HMC Capital is planning a new data center in Los Angeles, California.

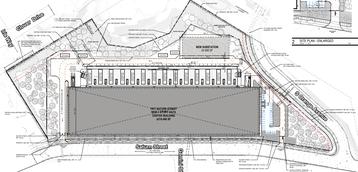

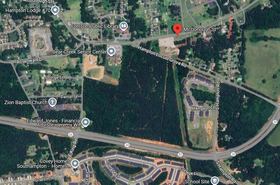

The company aims to develop a data center on a 15.8-acre site at 1977 Saturn Street in the City of Monterey Park.

HMC aims to demolish the existing buildings to develop a 218,400 sq ft (20,290 sqm) single-story data center and on-site substation. The site would include 14 4MW emergency diesel engines, suggesting a total capacity of around 56MW.

Construction could start as early as September 2025 and be completed by August 2027.

The site is currently occupied by a two-story commercial office building, an associated one-story utility building with a diesel-powered emergency backup generator, and a parking lot.

HMC filed for a public review of the development, known as the 1977 Saturn Data Center Project, last October. The company filed with the City of Monterey Park as well as California’s CEQA agency.

According to the documents, the existing buildings were constructed around 1979 and have been vacant since 2016. Then, as reported by the Los Angeles Times, HMC acquired the site in late 2024 for $39 million. The property was sold by EQ Office and had been under contract since March 2023.

HMC reportedly also acquired 1980 Saturn Street, the property across the road from 1977 Saturn, for $33.5 million.

Previous tenants on the subject property have reportedly included Lloyds Bank (1979-1984), Sanwa Bank (1986-2007), United California Bank (2002), Union California Bank (2003), FIS (2016), and Bank of the West (2008-2016). Documents suggest it was used as a printing facility/micro-film laboratory.

At one point, the property was proposed for use as an organ donation facility by OneLegacy.

Australian investment firm HMC has quickly established a sizable data center portfolio. After acquiring North American digital infrastructure investor StratCap in February 2024, HMC acquired Global Switch’s Australian unit and local operator iseek.

HMC has since launched DigiCo Infrastructure Real Estate Investment Trust (REIT), a new company to hold its data center assets. The REIT manages 13 data centers serving 586 customers and said it had agreed deals for the acquisition of three North American enterprise and hyperscale data centers for AU$2.29 billion ($1.5bn). It acquired one facility from Prologis in Chicago, Illinois.