Equinix reported quarterly results for the quarter ended March 31, 2012.

Revenues were $452.2 million for the first quarter, a 5% increase over the previous quarter and a 25% increase over the same quarter last year. Recurring revenues, consisting primarily of colocation, interconnection and managed services were $429.6 million for the first quarter, a 5% increase over the previous quarter and a 25% increase over the same quarter last year. Non-recurring revenues were $22.6 million in the quarter.

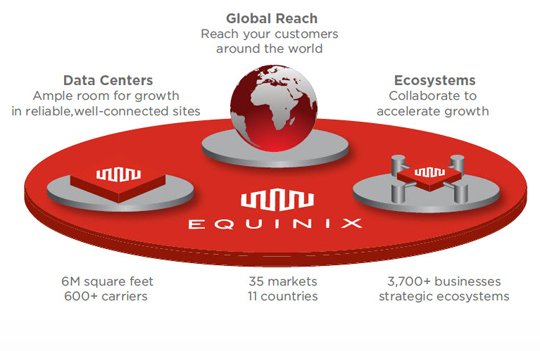

"Our strong first quarter results reflect growth in all three regions, which is being propelled by strong secular trends in mobility, cloud computing and data management, leaving us well positioned to achieve our 2012 objectives,” said Steve Smith, president and CEO of Equinix. “Global ecosystems being formed inside Equinix reflect these trends as well as our unique position to power the global digital economy."

Cost of revenues were $225.1 million for the first quarter, a 2% decrease over the previous quarter and a 16% increase over the same quarter last year.

Cost of revenues, excluding depreciation, amortization, accretion and stock-based compensation of $84.5 million, which we refer to as cash cost of revenues, were $140.6 million for the first quarter, a 2% decrease from the previous quarter and a 15% increase over the same quarter last year.

Gross margins for the quarter were 50%, up from 47% for the previous quarter and up from 46% for the same quarter last year. Cash gross margins, defined as gross profit before depreciation, amortization, accretion and stock-based compensation, divided by revenues, for the quarter were 69%, up from 67% for the previous quarter and up from 66% for the same quarter last year.