CoreWeave will commence trading on the Nasdaq today, March 28, with shares priced at $40 each.

The AI cloud company revealed pricing for its initial public offering (IPO) a day in advance of the launch.

Available under the ticker symbol CRWV, the company is offering 36.59 million shares of Class A common stock to be sold by CoreWeave and 910,000 shares of Class A common stock that will be sold by existing stockholders. CoreWeave does not profit off of the latter.

Should all 36.59 million shares be sold, CoreWeave will raise $1.463 billion. The remaining 910,000 shares total $36.4m.

The initial offering, starting March 28, will close on March 31.

Morgan Stanley, J.P. Morgan, and Goldman Sachs & Co. LLC are acting as joint lead bookrunners for the offering. Barclays, Citigroup, MUFG, Deutsche Bank Securities, Jefferies, Mizuho, Wells Fargo Securities, and BofA Securities are acting as joint bookrunners for the offering. Guggenheim Securities, M. Klein & Company, Macquarie Capital, Needham & Company, Santander, Stifel, and Galaxy Digital Partners LLC are acting as co-managers for the offering.

CoreWeave filed for the IPO toward the start of this month, though rumors had been circulating since 2024.

Shortly afterwards, reports emerged that the company's biggest customer - Microsoft - had canceled some contracts. CoreWeave denied that this was the case. Microsoft accounted for 62 percent of CoreWeave's revenue in 2024.

However, despite the company's assertions, the IPO will raise less than $4 billion that had previously been mooted, with fresh reports that Microsoft is scaling back data center investments perhaps contributing to weaker than anticipated investor demand.

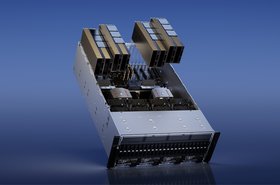

CoreWeave was originally founded in 2017 as a cryptomining firm, though it later pivoted to offering an AI cloud. At the end of 2024, it had 32 data centers operating more than 250,000 GPUs in total and more than 360MW of active power.