Colo supply in primary data center markets in North America has increased by 34 percent year-over-year to 6,922.6MW in 2024, according to a report from CBRE.

This far surpasses the 26 percent increase in new supply in 2023, with the report attributing the surge to increased demand and extended construction timelines.

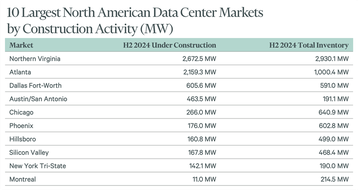

Primary markets in North America had a record 6,350MW under construction at the end of 2024, double the 3,077.8MW at year-end 2023.

The eight primary North American markets mentioned in the report are Northern Virginia, Dallas Fort-Worth, Silicon Valley, Chicago, Phoenix, New York Tri-State, Atlanta, and Hillsboro.

Demand continues to outpace supply

Vacancy rates in primary markets fell to a record low of 1.9 percent by year-end across all North American primary markets. Only a handful of facilities with 10MW or more are slated for delivery this year, leaving the sector with scarce availability of large-scale inventory.

"We saw unprecedented demand last year in the North American data center market fueled in part by AI and digital services - which drive a need for modern data centers - and investment from hyperscalers and developers,” said Pat Lynch, executive managing director and global head of CBRE data center solutions. “However, the risk of oversupply in the near term is minimal because of extended timelines for power delivery and wait times of 36 months or more for electrical equipment such as transformers, generators, and switchgear.”

Power demand is also a key consideration for site selection. Markets in North Carolina, Northern Louisiana, and Indiana are all poised for significant growth due to greater power accessibility, available land, and tax incentives.

A recent report from Newmark noted that power constraints were holding back growth. Data center developers are now exploring alternative solutions, from natural gas-fired power plants to investments in small nuclear reactors.

Atlanta dethrones Northern Virginia… almost

Atlanta knocked Northern Virginia off the top spot for net absorption in 2024, with 705.8MW. Perennial leader Northern Virginia reached 451.7MW.

The report notes that this is the first time any market has surpassed Northern Virginia in annual net absorption.

However, Northern Virginia is still the largest data center market with 2,920.1MW of total inventory. The report notes this is up 17 percent since last year.

Atlanta saw a 222 percent increase from the prior year and Phoenix saw an increase of 67 percent. Other notable markets include Dallas Fort-Worth, where developers currently have 605.6MW under construction with 87 percent of that new supply preleased.

Last month, plans for a two-million-square-foot (185,806 sqm) data center were filed just outside Atlanta. AWS has also revealed an $11 billion data center investment in Georgia, purchased 118 acres in Douglas County, just outside of Atlanta, for $37 million, and bought around 430 acres of land in Covington at the turn of the year.

Microsoft is also building several data centers in the Atlanta area, including in East Point and Palmetto in Fulton County, and Douglasville, Douglas County, having announced plans for a Georgia cloud region in 2021.

Secondary markets, such as Austin with 463.5MW under construction, may also share in the building boom this year.

In a report from JLL last September, the US data center market was reported to have doubled in size in just four years. Similarly, the report noted that Atlanta overtook Northern Virginia for the top spot in absorption.

Around the same time, CBRE said cloud and AI demand was driving North American data center vacancy to a record low, despite supply continuing to grow by a double-digit percentage.

Last month, CBRE predicted that 1GW of new colo capacity would reach Europe’s data center market in 2025.