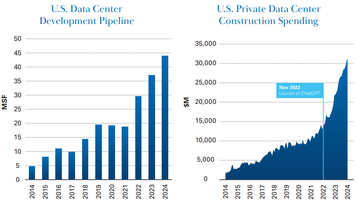

According to a report from Newmark, capital deployment in data center construction reached an all-time high of $31.5 billion in 2024, with growth showing no sign of slowing down this year.

Surprise, surprise, AI drives growth

Last year also saw the data center development pipeline reach nearly 50 million square feet, doubling the volume from five years ago.

Hyperscalers inked multiple transactions for data center campuses between 400MW and 900MW, with 2025 set to see the first official 1GW project.

It’s no surprise that the primary driver of this growth is AI. The report said hyperscalers such as Meta, Microsoft, and Alphabet are all expected to spend more on data centers in 2025 than last year.

AWS’ 2024 revenue hit $100 billion in 2024, with the tech giant projecting capex of $100 billion in 2025. Microsoft expects its 2025 capex to hit $80 billion, Google $75 billion, and Meta $65 billion.

Last year, development site purchases from hyperscalers were four times higher than their averages from 2010 to 2023. For the first time, hyperscalers surpassed 10 percent as a share of total development site purchases tracked by RCA.

Power constraints hold back growth

However, power constraints are significantly limiting growth, with projected power demands from existing and planned data centers exceeding what utilities are set to supply by around 50 percent.

The constraints are pushing data center developers to explore alternative solutions, from natural gas-fired power plants to investments in small nuclear reactors.

Several SMR firms have signed agreements with data center operators in the last 12 months, including Kairos and Deep Fission.

Sam Altman-backed Oklo has been the most active in the market. In January, the firm inked an MoU with RPower to deploy a power model that combines natural gas and nuclear power for the data center sector.

Before this, it signed a non-binding master power agreement with US data center developer Switch to supply up to 12GW of power through 2044. It also has agreements with Equinix, Prometheus Hyperscale, and two undisclosed data center operators. In total, Oklo has a customer pipeline exceeding 14GW of power.

AWS has also signed three agreements with Energy Northwest, X-Energy, and Dominion Virginia to support the deployment of more than 600MW of power across Washington and Virginia.

Northern Virginia in first place, West Texas hot on its heels

Northern Virginia reigned supreme once again as the leading region for development site purchases by hyperscalers, accounting for one-third of the total volume.

However, data center development is happening all across the US, in at least 23 states nationwide. Emerging markets such as Pennsylvania, the Carolinas, and Texas have become popular locations for data center firms.

West Texas in particular has emerged as a popular data center hub, due to its abundant and inexpensive power supply. The first phase of Stargate is expected to begin in Abilene, Texas.

Microsoft has invested in a data center in San Antonio, which serves as a hub for its Azure cloud services. Google and AWS have also planned facilities in the area.

The region has also seen an influx of cryptocurrency mining data center development, with 9.1GW of total potential crypto mining capacity over at least 17 announcements in the past three years. The report adds that 1.7GW of this is currently operational.

Cipher Mining currently has 75,000 mining rigs deployed at its two sites in Odessa and Alborz; both in Texas.

What’s next for 2025

The report said capital investment and data center development will show no sign of slowing down.

Despite DeepSeek’s cost-efficient AI model, hyperscalers are not likely to slow their capex plans in light of this cheaper model. Amazon already offers DeepSeek models on its platform.

However, data center developers will be competing for a finite skilled labor pool with other major construction projects - including manufacturing facilities and infrastructure projects.