President Joe Biden’s administration plans to help deploy 200GW of nuclear power in the US by 2050, tripling current capacity.

The roadmap would add 35GW by 2035 and see nuclear plants restarted, upgraded, and wholly built from scratch. It expects 15GW to be added per year by 2040.

In its report, the White House said: "In providing clean, firm electricity, nuclear energy has potential to meet critical loads that require high-quality, consistent power, such as advanced manufacturing, semiconductor fabrication, and data centers that power the Internet and advancements in artificial intelligence."

Data centers have struggled to find power in an increasingly constrained grid, just as AI has pushed campuses into the gigawatt range. As a result, a number of companies have explored nuclear power.

In September, Microsoft signed a 20-year Power Purchase Agreement with Constellation to take up 100 percent of a revived Three Mile Island nuclear power plant to power a planned 837MW Pennsylvanian AI data center.

Earlier, in March, AWS acquired the 960MW Cumulus data center campus in Pennsylvania, which draws power from Talen Energy’s neighboring 2.5GW nuclear power station in Luzerne County. Earlier this month, the Federal Energy Regulatory Commission (FERC) however rejected a proposed interconnection service agreement (ISA) for the nuclear power station that would have supported an expanded colocated load at the AWS data center connected to the 2.5GW plant, enabling it to serve the data center behind the meter.

AWS has also signed an agreement with Energy Northwest, a consortium of state public utilities, to enable the development of four advanced small modular reactors (SMRs).

Google, in October, signed a corporate agreement to purchase nuclear energy from multiple SMRs from Karios Power, with an expected deployment date in 2030.

Last month, the Department of Energy (DOE) said that tripling nuclear power was necessary to meet AI's growing needs.

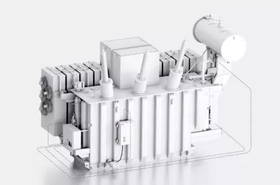

The new White House report covers traditional nuclear plants, microreactors, and SMRs.

"Although not yet commercially demonstrated in the United States, and with potentially higher, projected unit costs ($/kW and $/kWh) compared with large reactors, SMRs are attractive due to a smaller up-front capital investment and the potential for faster construction than large reactors," the roadmap stated.

"The lower, total capital costs and relatively smaller sizes of SMRs make them more accessible for customers and financers and suitable for more diverse commercial and industrial applications."

Last month, the DOE announced $900 million in funding for small modular nuclear reactor projects. It is also pumping $2.5bn into an Advanced Reactor Demonstration Program.

“Over the last four years, the United States has really established the industrial capacity and the muscle memory across the economy to carry out this plan,” Ali Zaidi, the White House national climate adviser, told Bloomberg.

Last December, the US signed a pledge to triple global nuclear energy capacity by 2050, and it said in its report that it would work with other nations to "deploy peaceful nuclear energy."

However, with the Biden Administration set to depart in January, it is not clear what the future holds for the strategy.

President-elect Donald Trump has spoken out in favor of nuclear power, but at the same time threatened to gut the agencies and funding that could help with a nuclear resurgence.