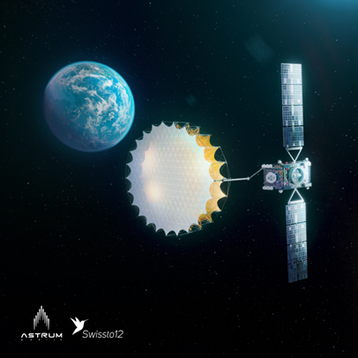

Singapore-based Astrum Mobile, a satellite-to-device provider specializing in smartphones and smart devices, has selected Swissto12 as the manufacturer of its NEASAT-1 satellite, based on the latter’s HummingSat small GEO platform.

The satellite will be operated geosynchronously from position 105E covering the Asia Pacific region, delivering 5G non-terrestrial connectivity at a 3rd generation partnership project standard. With reconfigurable beams, NEASTAR-1 will be able to change its service offering as the connectivity market shifts and evolves.

Services targeted as priorities include rich media, data casting, Internet of Things, and mass notifications including emergency notifications. The use of L-band is intended to prove resistant to radio frequency service fade as a result of severe weather in anticipation of a continuing pace of natural disasters in the region.

“Swissto12 was selected for its commercial approach, experienced satellite telecommunications team, as well as its small and agile spacecraft platform,” said Michael Do, chief operating officer of Astrum Mobile in a statement. “NEASTAR-1 is the fifth satellite in the HummingSat product line, benefiting from extensive manufacturing experience, heritage, and synergies to meet Astrum Mobile’s business plan."

Emile de Rijk, CEO and founder of Swissto12, touted his company’s pedigree in being able to deliver a powerful satellite-to-device payload within the compact size, weight, and power specifications of the HummingSat platform.

Based just outside of Lausanne in Switzerland, Swissto12 announced HummingSat’s development in 2022 under an ARTES Partnership Project with the European Space Agency, and has since sold the small GEO system to operators like Intelsat, now merged with SES, and Inmarsat, now merged with Viasat.

The company has claimed its HummingSat can be up to ten times cheaper than other GEO satellites. The machines measure around 1.5 cubic meters, loosely half the size of a small car, with 1,000kg of launch pass and able to support 200kg of payload capacity, supplied with 2kW of power with a predicted operational life of 15 years.

In 2024, de Rijk confirmed Intelsat and Inmarsat’s HummingSat orders were both on schedule to launch in 2026. Swissto12 declined to comment on the news.

The small GEO advantage

While the continental scope, network assurance, hardware longevity, and sheer range of geosynchronous satellite coverage still present clear advantages over LEO alternatives, the emerging consensus is that GEO does not possess the prestige it used to, which could well mean operators are willing to invest less in them, preferring more cost-efficient designs that tout the ability to do more with less.

Advocates of small GEO, or MicroGEO, believe the solution enables the same best-of-both-worlds compromise sometimes also attributed to medium Earth orbit, translating the compounding industry consensus around the viability of LEO constellations into support for solutions that use the same smaller, cheaper technologies in the higher orbits that are falling out of favor.

Comparable solutions include Boeing’s 702X and ESA’s SGEO missions with Hispasat 36W-1, as well as Astranis' satellite offerings.

“While LEO satellites offer an impressive amount of broadband capacity with low signal latency, small GEO satellite constellations can offer low-cost connectivity to customers with the lowest cost ground infrastructure,” Mike Kaliski, chief technical officer at Swissto12, previously told DCD. “The future will be built on integrated networks that combine the best services based on a delivery through the combination of LEO, MEO, and GEO assets.”

The best service in Astrum’s case has been a dedicated, regionalized, cost-effective solution serving specific and predictable sets of solutions across the Asia-Pacific service area, though this assumption depends on the uptake of satellite-to-device service to smartphones, which may become more effectively marketed with LEO services.

In the recent past, the East Asian and Southeast Asian markets have been eager to absorb Starlink capacity.

In 2024, Jose Del Rosario, research director at Northern Sky Research who is based in the Philippines, saw his Government “roll out the red carpet” for Starlink when it released a request for a proposal tailored for SpaceX. “That’s what [great] branding does,” he said.

The battle for satellite uptake in the Starlink age, especially in consumer sectors, isn’t just about technological prowess and resiliency arguments on paper, it’s about making the right arguments about agile alternatives like small GEO.