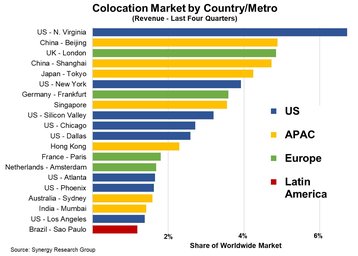

Twenty metro cities account for 60 percent of the world’s colocation market, according to a report from Synergy Research Group.

Northern Virginia is the single largest market, as is to be expected, accounting for almost seven percent of the total. Ashburn has historically been the most popular market in Northern Virginia, with the likes of Digital Realty, Centersquare, Cologix, NTT, Equinix, Aligned, QTS, EdgeCore, CyrusOne, Stack, and Compass having a presence in the region.

Following its lead are Beijing, London, and Shanghai, each accounting for around 5 percent of the total. Tokyo comes in fifth at 4 percent.

London has seen continued growth in East London's Docklands area, alongside the large Slough market to the west.

Of the top 20 markets, eight are in the US, seven in the APAC region, four in Europe, and one in Latin America.

After the top 20, the next 20 metro markets account for another 13 percent of the market, with the US and Europe featuring more prominently in the second batch.

The report also identifies rapidly growing markets outside the top 40, including Johor, Jakarta, Chennai, Lagos, Rio de Janeiro, Johannesburg, and Queretaro.

Equinix, Digital Realty, NTT, China Telecom, CyrusOne, and GDS were among the leading data center firms named by the report.

"Proximity to customers is a key driver of the colocation market, so data centers tend to be located in metros that have a large concentration of companies and economic activity. That will not change, but what we are seeing is the increasing emergence of many metros in countries that have smaller economies but which are growing rapidly," said John Dinsdale, a chief analyst at Synergy Research Group.

“Countries like Malaysia, Indonesia, Nigeria, and South Africa are all interesting opportunities, while in Latin America the market has developed beyond the historic focal point of Sao Paulo, and we're now seeing high growth in metros like Santiago, Rio de Janeiro, and Queretaro. It is also the case that increasingly, there are power or geographic constraints limiting growth in some traditional metros, pushing growth opportunities into neighboring regions. These emerging metro markets will not reach the scale of a Singapore or a Frankfurt any time soon, but they will increasingly reshape the evolving colocation market."