The satellite-connected Internet of Things (IoT) isn’t new. According to Ground Control’s Alastair MacLeod, some clients have been using a version of the technology for several decades.

Ground Control designs and builds satellite-connected technology including low-power small-form-factor satellite IoT devices and handheld, two-way messaging-enabled trackers. “We have clients that have been with us for almost 30 years, as an example of some of the oldest satellite-IoT use cases we have,” says MacLeod, highlighting a water company that needs to remotely monitor its treatment sites.

Those older cases are usually limited to the ultra-isolated locations where satellite connectivity was the only option, and if you go back to that point 30 years ago, that client would have needed somewhere between a 0.9-meter and 1.6-meter parabolic antenna - expertly installed - to enable their satellite-connected IoT.

Things have changed drastically since then, and IoT itself has experienced significant developments. The first IoT device was a connected toaster, created in 1990 by John Romkey for a bet. It was linked to the Internet via Transmission Control Protocol/Internet Protocol (TCP/IP) and could be turned on or off remotely. Romkey subsequently added a crane arm to insert the bread into the device, creating an end-to-end toasting system.

Romkey’s kitchen experiments came before the term IoT had even been coined, but in the decades since connected devices have become ubiquitous, with advancements such as 5G networks and Edge computing enabling rapid data transfers and localized data processing which reduce machine-decision time. Latterly, AI has added the possibility of learned pattern behavior and, as a result, better responses.

This is fabulous for places with solid connectivity and power infrastructure - there’s no reason powerful Edge computing solutions cannot be deployed if the requisite energy and networking infrastructure are available. But what about those more remote places? What about when you are at the edge of civilization?

Luckily, satellite technology has also been undergoing a parallel revolution. The first satellites were geostationary (GEO) - placed at an altitude of around 22,300 miles and directly above the equator, and not moving relative to the point on Earth directly below.

By the 1980s, Low Earth Orbit (LEO) satellites began to present a genuine challenge to GEO. These satellites reside at an altitude below 1,200 miles and are constantly on the move, orbiting the Earth in 128 minutes or less with an eccentricity of less than 0.25.

The proliferation of satellites

The number of active satellites in orbit has increased from 533 in 1994, to 8,377 in January 2024 - up a massive 1,472 percent. The bulk of that growth has occurred in the last few years, and is concentrated around LEO craft.

According to Ground Control’s Macleod, decreasing launch costs have been a big factor. “The cost of putting things in space has gone down dramatically and, depending on when you draw your yardstick, it could be by a factor of 10, or if you go back far enough, a factor of 100,” he says. “This has meant that the assets put in space don't have to cost billions of dollars or have a 30-year life, so more entrants have come into the market.

When the so-called “space tax” was higher, the only motivation to use satellite connectivity was if lives, or millions of dollars, were at stake. But as with any technology, as it becomes more affordable, it can reach a larger commercial audience, and in 2022 satellites were dragged into the world of 5G through the most recent update to 3GPP, Release-17.

3GPP Release-17

3GPP is an initiative that provides specifications across cellular telecommunications technologies. It was first founded in 1998, and set out to establish technical specifications and reports for a 3G mobile system - to standardize connectivity.

Release-17 was officially frozen, meaning it received no further additions or changes, in June 2022, and brought about a big change in the market.

“3GPP is the starting pistol on the convergence between space-based IoT, or satellite IoT, and terrestrial IoT, on what might come next, and broadly that is Narrowband IoT (NB-IoT),” explains MacLeod.

“[NB-IoT] is using the terrestrial IoT technology and protocol, and putting it in the space segment so that, eventually, you can have a device that switches between the terrestrial and space network.”

Release-17 includes a range of specifications for 5G non-terrestrial networking (NTN) for platforms at various orbits, including GEO, MEO (medium earth orbit), LEO, and HAPS (high altitude pseudo satellites). Specific to IoT is the release of 5G IoT-NTN, which provides throughputs ranging from one-100 Kbps, to Release-17 NB-IoT and eMTC (a low power wide area technology that provides a comparatively high data rate service for IoT applications) devices.

The release also includes two frequency bands to support this, both of which are in the 5G FR1 frequency range 255 in the L-band (1626.5-1660.5 MHz UL/1525-1559 MHz DL) with 34+34 MHz FDD bandwidth, and n256 in the S-band (1980-2010 MHz UL / 2170-2200 MHz DL) with 30+30 MHz FDD bandwidth.

MacLeod notes, however, that to date there is no one offering devices truly compatible with Release-17 and able to switch between space and terrestrial IoT network types seamlessly according to the 3GPP standards.

Andrew Nuttall, CTO and co-founder of Skylo, a GEO satellite connectivity provider, estimates that there are currently around 10 billion devices connected over cellular networks. ”There’s maybe a few million mobile satellite-connected devices, so if you look at those two ecosystems it’s around four orders of magnitude,” Nuttall says.

“People often have not just one, but multiple cellular devices connected in parallel. You can buy satellite phones and devices today, but it’s completely separate. You are buying separate hardware, separate equipment, and you’re paying different people.”

The vision is that IoT, and mobile phones, will be designed so that as they cross out of terrestrial connectivity, they can automatically switch to satellite. Devices will no longer be either or, they will be both, offering a much more reliable network as when a device loses contact with the terrestrial network and permanently available alternative can be used.

“Satellite is wonderful from a coverage perspective,” says Nuttall. “Anytime you see the sky, you have satellite connectivity. The challenge lies in it being a separate device, and that ecosystem has not really proliferated or grown at scale.”

Getting to that point, MacLeod predicts that we will first see people using 3GPP-type standards over satellite links, but they won’t immediately be interoperating.

“Things can change, but in order to make the space segment super efficient, it currently uses a data protocol that's referred to as NIDD - non-IP-based data delivery - which is optimized for trickier links,” explains MacLeod.

“But NB-IoT doesn’t use it, so the current style of addressing data communication in space isn’t mirrored by that on the ground network. Of course, that will change, but none of us knows exactly how long it will take.”

The silicon needed to enable devices to switch seamlessly is currently under development by the likes of Qualcomm and others, but isn’t yet widely available. Current estimated timelines seem to suggest it will be later this year. Regardless, a number of players are entering the space of space and making their play for a part of it.

Edge computing

There is some disagreement on what this will mean for Edge computing. IoT and Edge computing, in many use cases, go hand-in-hand. The issue lies in the location of these satellite-connected IoT devices.

For the most part, if you are opting for a satellite connection rather than a terrestrial one, you are in a remote place with very limited connectivity of other kinds. But alongside limited connectivity is often a limited power supply.

“Electrical power can be as scarce or even more scarce than connectivity,” says MacLeod.

The amount of power needed to run a satellite terminal in itself can vary significantly. At the higher end there is, for example, the Gen 2 Standard Actuated Starlink dish that uses 50-75 watts.

“We’ve had customers complain because something we sell uses five watts, and occasionally it might reach nine when it is transmitting,” Macleod says.

These power constraints also apply to Edge computing solutions. If you are struggling to find five watts for satellite data transmission, you are likely also going to be limited in the power you can use for data processing at the location.

But the other side of the coin is that satellite airtime is generally more expensive than terrestrial airtime, meaning that keeping data to a minimum is preferable, and consolidating that data may require Edge computing.

“What you want to do at the Edge is have as few end-points as possible and use as little data as possible,” MacLeod explains.

“A classic setup would be sensors all over the place which are then connected to LoRaWAN gateways to do concentration, and then those gateways communicate to the satellite terminal and send it back.”

Currently, MacLeod hasn’t seen many examples of this in the real world, but Skylo’s Nuttall predicts that the use of Edge computing is going to increase as satellite IoT grows. “If anything, this increases the need and desire to do Edge computing,” he says.

There are a few different motivations for Edge computing. “One, is you want to reduce the amount of data you backhaul, so you can make decisions locally,” says Nuttall.

The other key reason is latency, but if your Edge computing needs are to reduce latency by a few milliseconds, then realistically satellite connectivity isn’t the way to go.

“Additionally, this [satellite-connected IoT] is a narrowband service, this is not a broadband service. So if you’re generating gigabytes of data then you should not be backhauling that over this network, you should be doing your analysis locally and then just backhauling the results or outcomes.”

One scenario where Edge computing and satellite connectivity could coincide was posited by Shahbaz Ali, head of products at Sateliot, which provides satellite IoT services.

“An example could be an emergency forest fire response service in, say, the Amazon rainforest,” Ali says. “Edge computing would be necessary to take a decision right there and then based on data that sensors collected to trigger an anti-fire system, and you can’t have 100 percent connectivity guaranteed by any terrestrial network.”

As for whether that compute would ever happen actually on a satellite itself, or a space-based data center type deployment, Ground Control’s MacLeod is skeptical, saying he does not expect to see it “in the foreseeable future."

This is because the cost of getting compute into orbit, in addition to the cost to get the data transmitted to space, makes such a task impractical. “There’s too many things driving you in the opposite direction, the common sense direction, to do that,” MacLeod says.

GEO vs LEO

Skylo has committed to GEO satellites for its offering. Though data transfers from these crafts incur higher latency than their LEO counterparts, Nuttall says the company made this choice because its key purpose is to “solve the convergence of ecosystems by eliminating behavior changes.”

“There are plenty of different ways to connect devices over satellite, but there is a very specific set of solutions that enable that convergence,” he explains.

“We want to use standardized frequency bands because we don’t want to force people to choose bespoke technology solutions, we want to be able to use the globally harmonized regulated mobile satellite service spectrum assets, and we want to provide continuous and contiguous connectivity. To meet those three criteria, the only applicable satellites today are GEO.”

The current latency for those GEO satellites is around 500 milliseconds, which depending on your use case, could matter a lot or not at all.

Skylo has yet to officially launch its own satellite, but another company, OQTechnology, began investigating NB-IoT connected to LEO satellites in 2016, with the plan to build a constellation or network specifically to connect to low-power IoT devices.

Currently, OQ has 10 LEO satellites in orbit and has global coverage which it claims is commercially viable. It also purports to be Release-17 compliant.

Connectivity via LEO satellites is variable because, unlike GEO, they are constantly on the move. For OQ, revisit time - the time between which a satellite will return to the same point on the earth twice - sits between four-six hours.

“That’s good for some applications,” says founder and CEO of OQ, Omar Qaise. “A lot of IoT devices don’t have to constantly communicate and they are actually made for ‘burst’ communication. You can have them just powered by battery, and wake up to send a burst of data, and then go back to sleep.”

But as the company adds more satellites to its network, those periods of Internet desert will shrink.

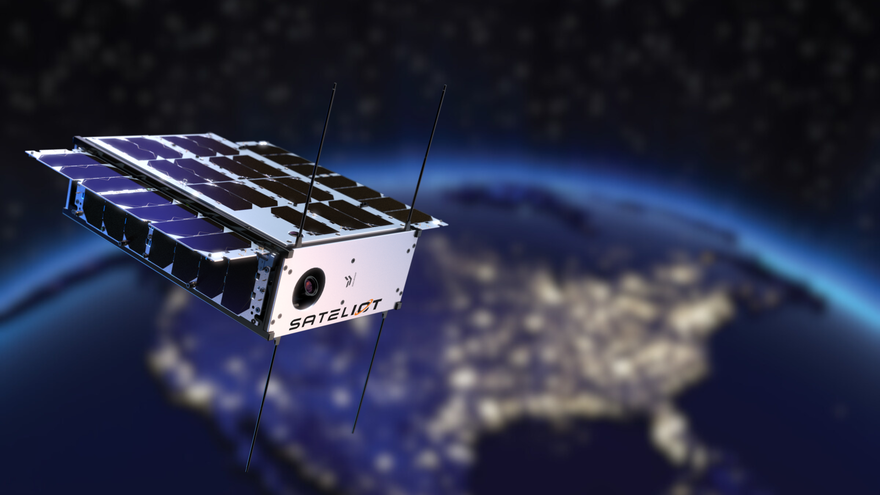

Sateliot, one of the companies that drum up a lot of noise in the IoT-satellite world, is also looking to utilize LEO for this purpose.

It was a major contributor to Release-17, and claims to be the world’s first NB IoT LEO satellite operator that is implementing that standard for the market.

Similarly to Skylo, however, Sateliot is not yet commercial. The company had deployed, as of December 31, 2023, five prototype satellites, even though it plans around 256 in the long term. As for when further satellites will rocket into space, the company has a launch date for some time this year, although it has not been shared publicly.

When those satellites have been launched, and the standardized NB IoT connectivity becomes available, mobile network operators will be able to offer seamless connections to satellite and terrestrial networks and Sateliot says it will be able to serve more time-critical applications in an affordable way.

Sateliot’s Ali concedes that while things are moving along in the world of satellite IoT, cost is still a constraint.

“What is stopping satellite-IoT from having massive adoption are the existing cost barriers,” Ali says. “Satellite connectivity hardware prices sit somewhere between $80 and $350, and then the connectivity is between $10 to $35 per device per month.

“That is very expensive when looking at sectors such as agriculture or livestock where you need to deploy millions of devices. There’s no business case for that.”

Overall, there is still some skepticism about the technology. OQ’s Qaise puts some of this down to the bad name the sector got after a lot of satellite IoT startups appeared, only to disappear. “This gave a bad vibe that the model doesn’t work for satellite operators,” he says.

MacLeod also dampens some of the hype, dispelling what he describes as some people “throwing a lot of capital up in the sky” along with claims of radical new technologies and a “new dawn.”

“Ultimately, the irritating thing about engineering and radio transmission physics, is the laws of physics don’t cease to exist. Space is always going to be further away.”